Virtual assistants have become increasingly in demand, now that there is a shift from the traditional nine to five corporate jobs to freelancing. A virtual assistant is also a job that is known to have a high-paying salary while working in the comforts of your home. If you are someone who’s looking for a job that only requires your desktop, a reliable internet connection, your ability to keep up with deadlines, and you want flexible hours, then you may want to consider applying as a virtual assistant.

But apart from these, what makes a virtual assistant different from other jobs? Read more to find out!

What is a Virtual Assistant?

A virtual assistant or VA in shorter terms is a remote employee or an independent contractor who renders services to their clients or companies locally or abroad. They provide administrative, creative, or secretarial services and they perform them in remote locations, wherever they are in the world.

People who are employed as VA work from home, sometimes following the schedule of their clients or companies. They usually perform typical administrative assistant work, but VAs have more flexible hours as their work will depend on the influx of work or tasks needed to be done.

Virtual Assistant Job Description

A virtual assistant may be hired depending on the task that needs to be done. Different clients have different needs and having a wide range of skill sets can help you land a job faster. Below are some of the things that a virtual assistant may do for their client. Some of these items may fit the job description of a virtual assistant.

- General administrative duties

- Data entry

- Technical support

- Scheduling appointments on calendars,

- Arranging travel bookings

- Creating SEO content or other blog posts

- Managing social media

- Create or edit graphics

Common Skills Needed to Become a VA in the Philippines

Now that you are aware of what virtual assistants usually do, you need to be equipped with these basic skills. Here are some skills a client or a company looks for in a VA:

Communication

Having excellent communication skills is vital as most of the work would include writing and sending emails, calling customers, and dealing business with other clients.

Time Management

Most clients always impose strict deadlines, and that’s why you need to manage your time properly to finish tasks and meet those deadlines.

Familiarity with Project Management Tools

You cannot be a VA if you do not know any software or project management tools such as Microsoft Office. VAs must also be adept at creating strategies for the development of their client’s businesses. You need to be aware of the modernities of the marketing industry, so you need to be creative and well-versed in project management by utilizing these tools.

Good Typing Speed and Accuracy

Some clients require their VAs to transcribe a meeting or conference. Most clients require a typing speed of 60 words per minute, and it must be 99% or 100% accurate.

Detail-Oriented

As most VAs can multi-task, this doesn’t mean that they have to sacrifice the quality of their work. Clients highly require clients to have a keen eye for detail, no matter how minor it may be.

Social Media Management

Everyone is heavily reliant on social media. If you are a VA assigned as a social media manager, you need to know how to use social media platforms, create events online, and interact with users online. You must also know how to promote your client’s products and services online and cross-post them on various social media platforms.

Qualifications of a Virtual Assistant

There are no fixed, and hard-and-fast requirements for someone to become a virtual assistant. Some companies require certain educational attainment, some may also ask a prospective VA to have specialized training in a particular field. Some clients and companies offer certification courses for virtual assistant skills.

But for beginners, a VA must be tech-savvy, with vast knowledge of IT-related programs and software. If you are applying as a bookkeeper virtual assistant, you must know basic accounting skills. Hence, being computer literate is a must.

When it comes to educational attainment, the youngest preference by most clients is that you are a high school or college graduate. As most companies don’t mind your educational attainment, what is important is that you know how to follow instructions, you are organized, and can meet deadlines.

You must also have a previous experience in the secretarial or administrative field. An administrative assistant is one of the usual previous job experiences of those applying to become a VA.

Lastly, you need to have excellent communication skills – both oral and written. This qualification is a no-brainer, as you will be dealing with customers and clients all around the world. Communication is crucial when you are working as a virtual assistant.

In sum, you only need relevant experience to become a virtual assistant. But having certifications and high education attainment can be an edge to land on the job that you want.

How to become a virtual assistant

Becoming a virtual assistant is not as difficult as it seems. If you don’t know where to start, here’s a quick guide to help you begin this journey.

1. Decide Which Services to Focus On

A virtual assistant is a flexible job, and there are hundreds of services you can enter. However, it would be hard for you if you take on all of these services. Based on learnings, it’s recommended to find your niche, whichever your strength is, and focus on that. It’s better to sell yourself as an expert in the field instead of a generic jack of all trades.

As a starter, you may choose around three services that you want to focus on and check in the next few months how you’ve handled them. If you’ve done well, you may add two more, but if not, better to get used to these first before expanding.

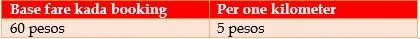

2. Fix Your Rate Card

Most charging payments of virtual assistants are not straight-forward. Your rate will still be handled on a case-to-case basis but better to standardize for reference. You may place options in your rate card depending on the nature of work and the frequency of availing your services. Make sure to base your price on your length of experience and level of experience because your client will surely take that into consideration.

As an example, always keep in mind that VAs that are tech savvy and offer services that require technical skills like search engine optimization, website development, graphic design, and video editing, will most likely charge higher than generic VAs. This is because they have invested time and money into their training as well.

From here, check on what services you’ll allow being charged per hour, per month, or on a per-project basis.

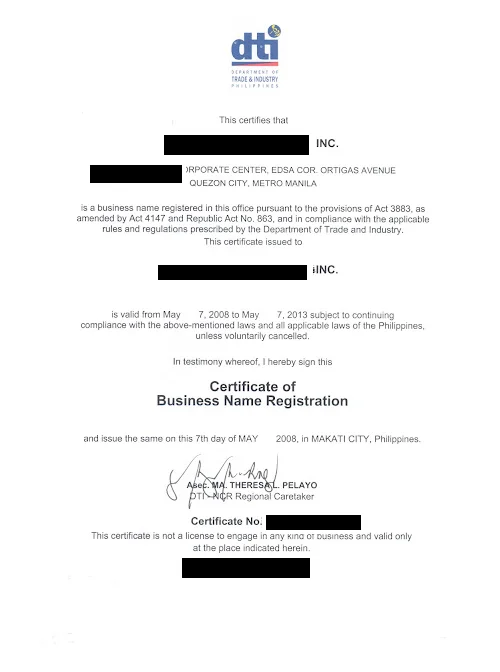

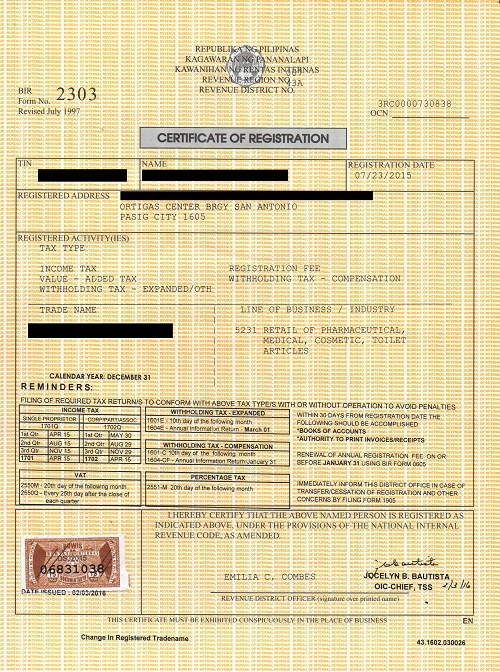

3. Legally Set Up Your Business

Make sure to legally set up your business when starting out. Decide whether you’ll operate as a Sole Proprietor or a Limited Liability Company.

The fastest way to bring your business to life is by being a Sole Proprietor since there’s no special setup for this. The only downside for this option is that should there happen to your business, your personal assets will be at risk.

Another option is through the Limited Liability Company. There are more requirements needed for this route but what’s good about this is that your personal assets are protected just in case someone sues your business.

Aside from these, it’s better if you also prepare your contracts at the start. Have your templates ready including the necessary conditions between the client and you – from the payment, timeliness of payment, specifics on the services offered, and more. This will assure that both parties are covered should something come up.

For a smoother process, it’s recommended that you consult both an accountant and an attorney. This will ensure that your moves are in place before you fully offer your services.

4. Finalize Your Branding

After you’ve worked on the three prerequisites above, it’s now time to work on your branding. This is a crucial step as you won’t be able to fully market and sustain your business without your company name and logo. Make sure that your branding will fully encapsulates the services you are offering and the kind of service you are planning to offer to your clients.

5. Craft Your Social Media Platform and Website

One of the easiest ways to market yourself is through social media. We suggest that you separate your personal profile from your professional profile so that your posts and engagements won’t get mixed up. When setting up your pages, always ensure that your branding is well-represented in your account and that the services offered and rates are clear to the potential clients.

It’s also recommended to create a website to promote your business. It’s a more formal and professional way of introducing yourself to the market. Think of this as your virtual resume so make it count. Always remember that your services and pricing should not be the main start here. Ensure that you get to capitalize on this platform by showcasing your portfolio (the past works you’ve done) to add to your credibility. Don’t also forget to include where your audience can contact you as this is the most critical part of your website.

6. Find Your First Clients

Once you have set up everything, it’s now time to jump into the real world – finding clients. It may be daunting to contact your first lead and land your first client but you’ll get more comfortable as time passes by.

7. Attend training programs for virtual assistants

Attending training programs for virtual assistants is also a great way to hone your skills and find clients. Attending such programs before starting your virtual assistant career could give you an advantage. You’ll not only learn the foundations of being a virtual assistant, but you could also learn how to find clients.

Fully Booked VA and PinterestVA are some examples of those that offer virtual assistant training programs. You can learn from their online courses, get certificates, and get access to potential clients.

Where can a virtual assistant find clients?

The shift towards remote work increased the opportunities for virtual assistants. As a virtual assistant, knowing how to stand out among others would help you find clients.

Here are the top places you can explore to find clients:

- Get referrals from past or current clients

- Land clients from social media

- Find nearby businesses or communities in your city or town

- Visit reliable websites

Get referrals from past or current clients

Your past and current clients already have an idea of what you can do. You can find new clients by asking them if they know anyone who might need your services too.

It highlights the significance of building a relationship with your clients since they can also be a testimony to the quality of your work and your work ethic. A bonus tip is that you can give them a simple gift or token whenever they give referrals. These incentives may encourage them to refer more people to you!

Land clients from social media

Social media plays a significant role in today’s modern world, especially for businesses. Since many people and businesses use social media, it makes it a great place to find clients.

Firstly, you can explore Facebook by joining groups and creating your business page. By joining paid or free Facebook groups, you can engage, contribute, and build rapport with potential clients. Although attracting clients is good, you also need to prioritize building connections or expanding your network.

For your business page, you can use it to promote your services, portfolio, testimonies, and service rates. It’ll help your future clients connect with you efficiently.

Similar to Facebook, you can also create an Instagram account for your business or services. Although Instagram doesn’t have the same functions as Facebook, you can still use it to showcase your work. It’ll help your potential clients get to know you further.

Apart from those social media apps, you can also create a website for your business. You can promote it on your social media accounts too!

Find nearby businesses or communities in your city or town

Going out of social media, you can also find clients in nearby businesses and communities. Try meeting people from your city or town to make connections. It’s also a great way for you to meet your fellow freelancers and learn a thing or two from them.

The goal of exploring social media and your local community is for you to reach where people are. It doesn’t only enable you to reach your family and friends, but also strangers and fellow virtual assistants. Immersing yourself in diverse communities will enlighten you on the needs of your target market.

Visit reliable websites

One of the easiest ways to scout opportunities is by visiting websites that are popular for freelance writing job postings. Here are some of the best ones that you can visit as a starter!

- Fiverr: This platform is one of the friendliest websites for starters. Although you won’t find a lot of high-paying opportunities there, it can be your stepping stone to building your portfolio and helping you build your professional experience.

- FlexJobs: FlexJobs is a job board that presents all remote work, both freelance and part-time, that you can apply for. They have a strict posting process that’s why it’s known that all the opportunities listed here are real. Because of the work done in preserving their name, they require all members to pay $14.95 per month. What’s good about them is that they offer a 30-day money-back guarantee. If you feel that their services and chances of landing a high-paying job are low, you may opt to ask for a refund.

- Upwork: Upwork is home to a lot of freelancers in the world. Because of the demand on this platform, there is a high chance that you’ll get a job lower than what you expected. The main advantage of this platform is that it has a user-friendly interface, making your chances of finding a job higher than the others.

Is it hard to become a virtual assistant?

The tasks performed by virtual assistants are similar to administrative or secretary work. The job might seem overwhelming due to the long list of administrative work; however, virtual assistants could have specific jobs based on one’s skill sets. For example, a virtual assistant may focus only on bookkeeping, customer support, or research.

Since virtual assistants work remotely, it eases the burden of frequently going to the office. Also, working from home allows you to work for different companies at once.

In terms of education, a college degree is not required to become a virtual assistant. However, having a degree will help you land your ideal clients. Virtual assistants are mostly required to undergo training and earn certifications. Since there are lots of administrative work, enhancing your skills is essential for the job.

Here are some of the skills that you can improve the quality of your work as a virtual assistant:

- Organizational skills

- Communication skills

- Technological or Computer skills

- Multitasking

- Time management

- Interpersonal skills

How to get my first job as a virtual assistant?

Searching for jobs online is a great start for new virtual assistants. There are many job postings for virtual assistants online, where you can filter them according to geographic location, salary, job type, schedule, company, etc.

Jobs for virtual assistants are not limited to corporate companies. You can also apply in other industries such as healthcare, real estate, law firms, marketing agencies, and engineering firms.

For your application to stand out, you can highlight your skills and the things you can contribute to the company. You can also share your achievements from training and workshops.

However, before you start your first job as a virtual assistant, keep in mind that you need to have equipment like a computer, microphone, and camera. If the job requires specific and specialized equipment, companies often provide them for you.

How many hours do virtual assistants work?

Virtual assistants usually work for a minimum of 20 hours per week. However, some virtual assistants can work for less than 20 hours. Since it is much lower than the usual 30 to 40 hours per week, companies could decrease their costs.

Also, there are available full-time and part-time jobs for virtual assistants. Some are required to work for specific hours while others are given a deadline instead.

For clients looking for a virtual assistant, requiring a minimum of 20 hours per week means that they could only work for you a couple of hours per day. It allows the virtual assistant to work for another client simultaneously to earn more. Hence, there are tendencies where they won’t be able to respond or attend to you quickly.

Are virtual assistants in demand?

Virtual assistants are considered an in-demand job due to the growth of online businesses and remote work. More companies have also begun outsourcing, which increased the opportunities for virtual assistants. By hiring virtual assistants, companies could have a diverse pool of talent, reduce the need for office space, lessen the burden of managing employees, and reduce costs.

These are the specific in-demand virtual assistant services that companies look for:

- Cold-calling

- Taking customer calls

- Email communications

- Customer scheduling

- File management and maintenance

- Social media marketing

- LinkedIn lead generation

- Website design and development

- Bookkeeping

- Video editing

Companies hire virtual assistants to perform common and repetitive but essential tasks. By doing so, they can save time and focus more on other factors to further grow the company.

Is there an age limit for virtual assistants?

Age does not matter when applying for a virtual assistant job. As long as you are of legal age, you can work as a virtual assistant.

Apart from age, clients focus more on your skills, discipline and work ethic, communication skills, and willingness to learn and ask for help. These factors emphasize that being tech-savvy is not enough in becoming a good virtual assistant.

As mentioned earlier, clients also look at your education, training, and certifications. Examples of the certifications that you can earn are Certified Virtual Assistant, Microsoft Office Specialist, Google Ads Certification, and Language Certification.

How much does a virtual assistant make?

In the US, the average base salary of virtual assistants is $24.42 per hour, making it $73,555 per year. For basic jobs, the salary range is $8 to $12 per hour.

Since virtual assistance is remote work, you can also apply to more expensive cities or countries, which may increase your salary range. In the US, the top five highest-paying cities for virtual assistants are San Francisco, Fremont, San Jose, Oakland, and Tanaina.

You can increase your income and earning potential by accommodating more clients, building a stable clientele, and specializing in services.